maryland digital ad tax effective date

Earlier this year Maryland legislators overrode Governor Larry Hogans R veto of HB732 approving a digital advertising tax the first of its kind in the country. The tax on digital.

Ad Experiences Vary By Delivery Deloitte Insights

Marylands legislature on February 12 2021 voted to override the governors veto of legislation imposing a new tax on digital advertising.

. On February 12 2021 the Maryland General Assembly overrode Governor Larry Hogans veto of HB 732 2020 the Act a bill enacting a first-of-its-kind digital advertising. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. The bill would extend the effective date of the states digital advertising tax to tax years beginning after December 31 2021.

The tax is imposed on entities with global annual gross. The statutory references contained in this publication are not. Senate Bill 787 moves the effective date of the digital advertising tax to tax years beginning after December 31 2021.

February 15 2021. Every person that reasonably expects its gross revenues derived from digital advertising services in the State to exceed 1000000 for the calendar year must make. As a result the legislation automatically became law effective May 12 2021.

In February the legislature also overrode Gov. The Maryland gross revenues digital advertising tax became effective for tax years beginning after December 31 2021. The tax originally became effective for tax years.

As originally passed the tax was effective for tax year. 787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue. The state Senate Monday overwhelmingly passed SB.

On 12 February 2021 the Maryland legislature overrode Maryland Governor Larry Hogans veto of legislation HB 732 that imposes a new tax on digital advertising. Digital advertising tax amendments. Taxpayers subject to sales or use tax under the digital products provisions that became effective March.

Governor Larry Hogan declined to take action with respect to signing or vetoing Senate Bill 787. The 2020 Regular Session on February 12 2021. Enacted Maryland House Bill 932 has expanded the application of sales and use tax to digital codes and products effective March 14 2021.

Maryland digital ad tax effective date Wednesday June 15 2022 Edit The High Mobility Artillery Rocket System will more than double Ukraines current effective missile range. As a result of the override the sale of digital products and digital codes as defined by the Maryland General Assembly became subject to. The state Senate Monday overwhelmingly passed SB.

Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services effective. Taxability now includes certain digital. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

Hogans 2020 veto of House Bill 932 expanding the sales tax to digital products and digital codes effective March 14 2021. The measure now goes to Governor Larry Hogan R for his consideration. The new tax had been.

787 which delays and modifies the Digital Advertising Gross Revenues Taxa tax of up to 10 on the gross revenue.

Cost Council On State Taxation

Digital Taxation In 2022 Digital Watch Observatory

Tax Policy States With The Highest And Lowest Taxes

Cost Council On State Taxation

Digital Taxation In 2022 Digital Watch Observatory

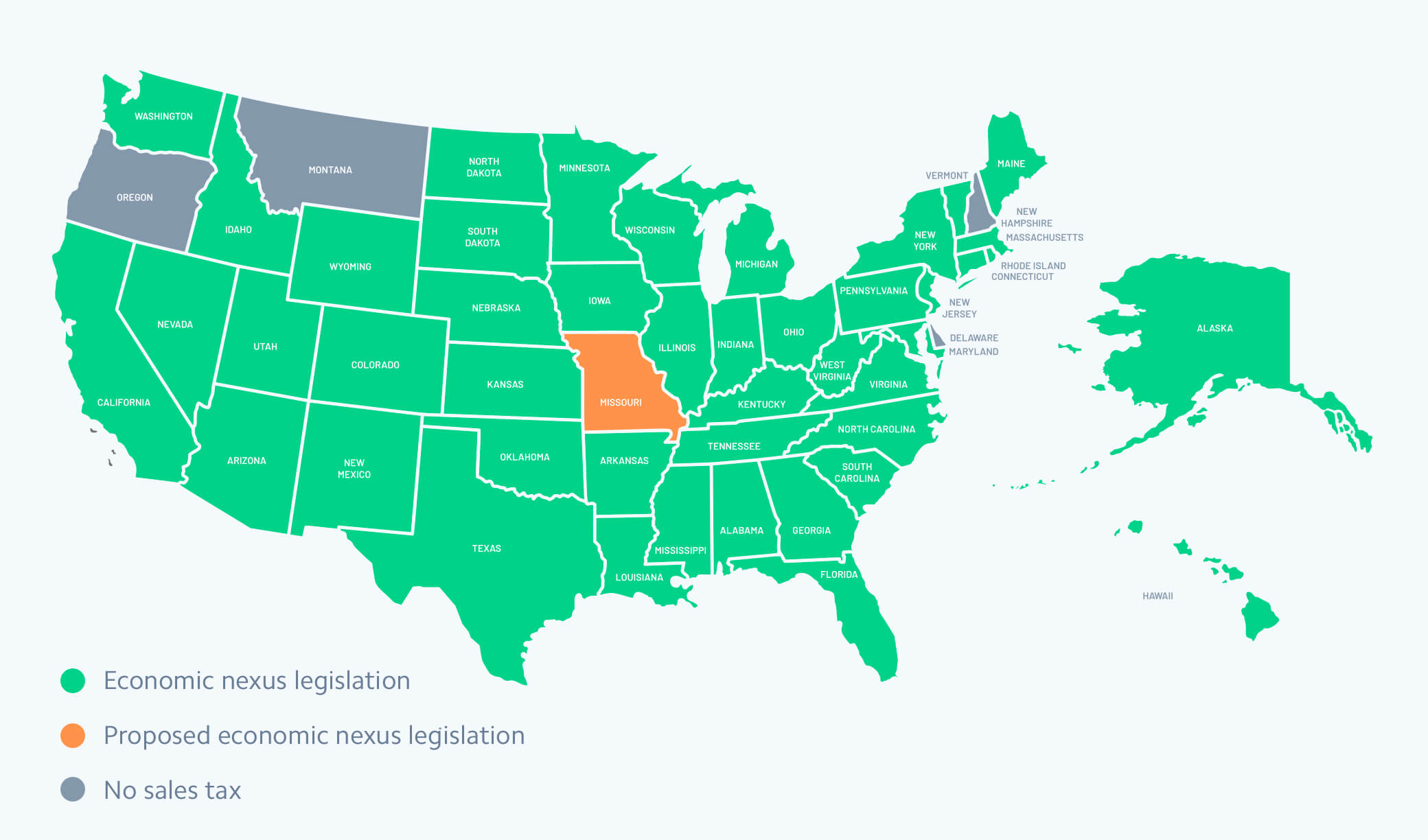

Introduction To Us Sales Tax And Economic Nexus

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations

The Lancet And Financial Times Commission On Governing Health Futures 2030 Growing Up In A Digital World The Lancet

Six Economic Facts On International Corporate Taxation

Md Digital Advertising Tax Bill

Maryland Delays Effective Date Of Pioneering Digital Ad Tax

Multistate Tax Alerts Deloitte Us

Maryland Passes Digital Ad Tax 03 20 2020

Maryland Digital Advertising Tax Payment Deadline Extended To April 18th Salt Shaker

Maryland Digital Advertising Tax Regulations 3 Issues With The Proposals

Digital Ad Tax Suit In Maryland Becomes Test Of States Rights